eGrocery Boom:

Who’s Really Winning?

eGrocery sales just hit a new record, but are grocers gaining market share or losing ground to bigger competitors?

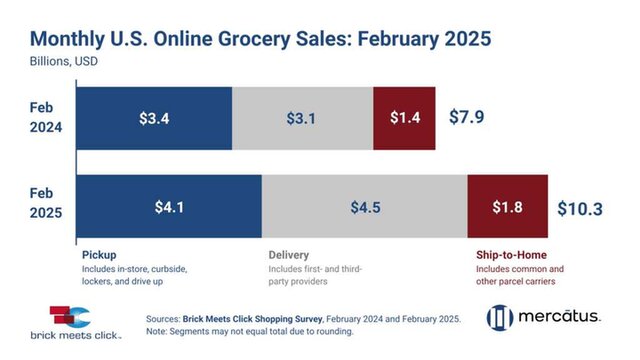

For the seventh consecutive month, U.S. online grocery sales surpassed $9.5 billion, reaching $10.3 billion in February 2025—a 31% year-over-year increase.

The surge reflected in February’s Brick Meets Click/Mercatus eGrocery Sales Report is no coincidence. More than 80 million households placed at least one online grocery order last month, marking the highest level of adoption to date.

Consumers continue to take advantage of deeply discounted annual subscription and membership deals from eGrocery’s biggest players. But as these 12-month deals mature, the real challenge for grocers isn’t just sustaining the momentum—it’s capturing a larger share of it.

To stay competitive, it’s essential to track where the market is headed, how fulfillment trends are shifting, and which strategies are proving most effective at strengthening customer loyalty.

Here’s what you need to know from Februar’s Brick Meets Click/Mercatus eGrocery Sales Report:

- The U.S. eGrocery market reached $10.3 billion (+31% YOY) in February 2025.

- More than 80-million households placed at least one online grocery order in February, a new record for eGrocery adoption.

- Delivery overtook pickup as the preferred fulfillment method:

- Delivery Sales: $4.5 billion (+45% YOY, 44% market share)

- Pickup Sales: $4.1 billion (+19% YOY, 39% market share)

- Ship-to-home Sales: $1.8 billion (+29% YOY, 17% market share)

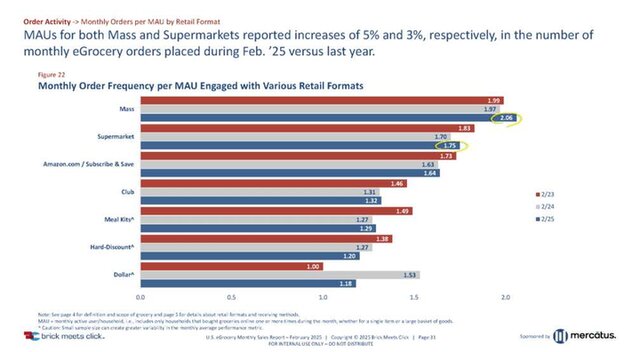

- Both the supermarket and mass retailer segments saw positive trends across all three core sales drivers: MAUs, order frequency, and AOVs all increased YOY.

- Grocers narrowed the repeat intent gap with mass retailers, reaching a post-COVID high for likelihood of reuse.

These numbers confirm that eGrocery adoption is stronger than ever, but with more customers shopping online, the real challenge is keeping them engaged.

Despite record-breaking eGrocery adoption, regional grocers haven't benefitted the same way as mass retailers and third-party providers.

There are promising signs—repeat intent is rising, and pickup continues to grow organically.

But to turn these trends into lasting gains, grocers must act now to strengthen customer relationships, improve convenience, and deliver a better overall experience.

- Strengthen First-party Ordering - Walmart captures 80%+ of its online orders through its app or website, compared to just 50% for regional grocers who still rely on third-party services.

To shift more customers to direct ordering, grocers must offer better value and incentives on their own platforms. Differential pricing, loyalty rewards, and a seamless user experience can drive more traffic to first-party channels, reducing dependency on third-party providers and boosting margins - Reduce Friction in Pickup - While delivery has surged due to heavy discounting, pickup is growing on its own without these incentives—proving its long-term value.

Since pickup remains the most cost-effective fulfillment method, grocers must make it as seamless as possible to increase this organic adoption. Improving order accuracy, reducing wait times, and enhancing pickup efficiency will strengthen its appeal. Better time slot availability and proactive communication can also improve the experience. - Convert First-time Shoppers into Repeat Customers - The recent spike in first-time repeat users shows that many customers are trying new services—and enjoying their experiences enough to come back. However, Walmart and other mass retailers are capitalizing on this trend, too.

To build long-term loyalty, grocers must deliver a seamless first-time experience alongside compelling reasons to return. Personalized promotions, consistent fulfillment, and integrated loyalty rewards are vital to this. A strong first impression drives retention, but continued engagement through tailored offers and a smooth shopping journey will turn shoppers into loyal, high-value customers.

Subscription-driven promotions won’t last forever.

To claim a larger share of eGrocery growth as these initiatives reach maturity, grocers must increase ownership of their customer experience, eliminate fulfillment frictions, and engage shoppers for repeat business—before mass retailers do.

Three Ways to Capitalize on eGrocery Momentum

Closing Thoughts