Beyond the Pandemic Era:

The Reversal Opportunity

As a leader in US consumer data, Earnest Analytics has a 10,000 foot view of consumer spending, demographics, geolocation, product pricing, healthcare, and economic trends. That view changed substantially over just the last six months as several of the defining retail and ecommerce trends of the pandemic reversed. I see three of those trends in particular continuing into 2023.

Since January of 2022, spending by Earnest Analytics panelists making credit card interest payments–i.e. with debt–grew faster than those without interest payments. That means the fastest spending growth in the US economy is now coming from credit card debt holders. This is a reversal from the last two years when non-debt holders' outpaced debt holders’ spending. Shoppers were likely using government stimulus checks to pay down debt and not increase their spending in 2020 and 2021. This recent rise in debt-fueled spending also suggests that COVID-era savings, either from depressed consumption during the pandemic or government assistance, are depleted for many families. Recently, some US states delivered inflation assistance in the form of tax credits or direct deposits that may have driven some demand during the holidays. Once those reserves are also depleted, consumers will likely not see another government windfall to boost spending. All of this as the Fed increases interest rates to combat inflation. The average interest payment in Earnest card data was 14% higher in November 2021 than in January of 2020, which will likely translate to additional pressure on consumer wallets. We are likely seeing the finale of the pandemic era spending euphoria.

Credit card debt is back to fueling US retail spending.

We are likely seeing the finale of the pandemic era spending euphoria. We will likely not see another government windfall to boost spending. Data indicates consumers are facing additional pressure on their wallets.

Lower income consumers are trading down from 2021.

Amazon is reconsolidating its online marketplace lead.

Under $55k Earners Are Flocking to Dollar Stores

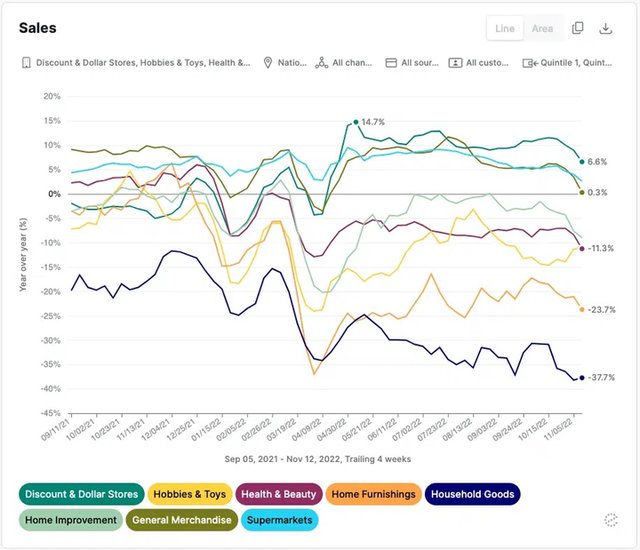

Credit and debit card spending by households making under $55k per year at national dollar store chains like Big Lots, Dollar General, Dollar Tree, and Five Below materially outgrew their spending across other major categories since April 2022 (including hobbies & toys, health & beauty, supermarkets, home furnishings, household goods, and home improvement). This suggests low income earners are trading down for cheaper alternatives compared to 2021 when they benefited from stimulus checks and a more optimistic economic outlook. In contrast, dollar store spending by shoppers earning over $55k was in-line with other consumer staples categories like supermarkets and general merchandise (think Walmart). This suggests higher income individuals have not yet traded down to dollar stores, though they may be substituting for lower priced products in the same stores. The trend suggests there is ample opportunity for discounters to pick up share in 2023.

For a brief time in 2021, Etsy, Ebay, and QVC were the fastest growing marketplaces in the US, likely stealing share from Amazon. Fast forward to today, and most online marketplaces are at or just below year ago sales levels. In turn, Amazon has reclaimed the online marketplace crown with exceptional growth headed into the 2023 holidays. During Black Friday, almost 1-in-4 US shoppers spent their largest share of wallet at Amazon despite its relatively smaller October Prime Day than in years past. Meanwhile sales at legacy marketplaces were flat or down compared to year ago levels. Amazon’s reconsolidation of online marketplace sales from more niche marketplaces is a trend we see continuing into 2023.

Powered by Earnest’s Orion spend dataset.

Low-income consumers are moving their wallets to dollar stores according to Earnest Analytics’ credit and debit card data in the face of high inflation.

Michael Maloof leads Earnest Analytics' strategy and growth marketing team. Michael has extensive experience writing consumer behavior research, which has been published by The New York Times and WSJ. Michael worked at Goldman Sachs Global Investment Research, covering tech and telecom, prior to joining Earnest Analytics (then known as Earnest Research) as a startup. He holds an MBA from the University of Denver's Daniels College of Business.